Welcome to ABCs of Bookkeeping!, a full service bookkeeping firm located in Bellingham, WA. For more than 30+ years Kris Halterman has provided bookkeeping services to assist the small business owners and new entrepreneurs to set up and maintain their financial accounts, greatly increasing the ability of their business to succeed. In 2020, Kraig Halterman joined the business and has taken over the bulk of the business operations.

Your business requires you to pay attention to the operations and growth of the business; with the qualified services of ABC's of Bookkeeping you can do that.

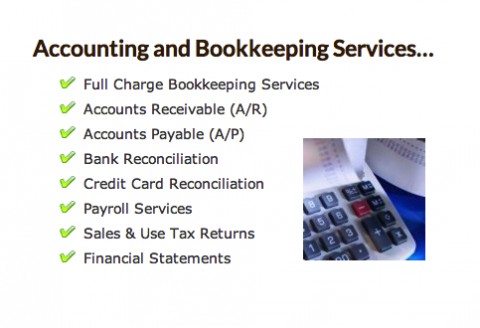

ABC’s of Bookkeeping provides professional, high quality, bookkeeping services to individuals and small or medium size businesses, throughout Whatcom County. ABC’s of Bookkeeping will set-up, clean-up and maintain your financial records. This results in a clear financial picture and aids in the success of your business.

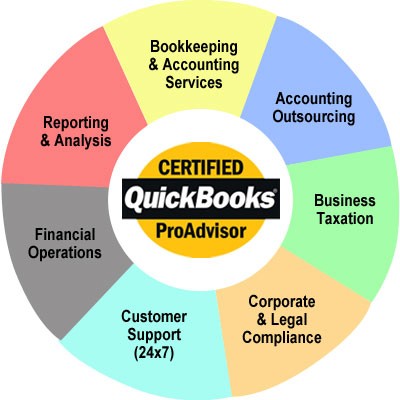

Kris Halterman started bookkeeping for the family business in 1986. In July of 2008, ABC's of Bookkeeping was created to help more small businesses in need as ABC Bookkeeping, Inc. Through the power of Intuit's QuickBooks, Kris earned QuickBooks Pro certification and continues to expand her knowledge of QuickBooks software and how it can be used to help businesses grow. In 2020, Kraig Halterman started training with the company and is now the owner of ABC Bookkeeping, Inc. Kris continues to help out with client services as she takes time for herself, her family. and slowly moves into semi-retirement.

ABC's of Bookkeeping has a range of accounting and bookkeeping services that we tailor to your business needs:

Let ABC's of Bookkeeping present our package of services through a free consultation.

Contact Kraig or Kris Halterman by email:

or by phone: Kraig Halterman (360) 510-5065, or Kris Halterman (360) 739-5890

ABC's of Bookkeeping's goal is to provide you and your business with a clear financial picture so "you" can focus on your business' product and services.